I was running a few numbers recently – a part of my job that I find delightful – but this time it was a bit different. I was testing out various saving rates on my own financial plan instead of a client’s, which got me thinking: If I’m swimming in data when I do this for myself, what is everyone else doing?

The most basic goal should be to arrive at “your figure” for financial independence – or as I like to say, that time when I can work because I feel like it and not because I must. The problem is, many people aren’t hitting that goal – or even know how to set that goal.

Just look at the figures in this article from TIME.com (1):

- 38% of Americans aren’t currently saving.

- 91% of Americans don’t contribute the maximum amount into their retirement plans.

- 80% of Americans believe they won’t have enough money for retirement.

Far too many of us are falling short of financial independence. Maybe it seems too difficult to achieve. Maybe it seems like too much work. Maybe it seems overcomplicated. Whatever the reason, financial independence is achievable. And it really boils down to three simple steps.

Step 1: Determine Your Length of Retirement

The general thought is that retirement age is 65. This is true for some, but not everyone. You may want to achieve financial independence earlier or work into your 70s. Regardless of when you’re ready to retire, you’ll need to know how long you’ll need your savings. To find that number, ask yourself three questions:

How much do I spend?

Some retired people spend significantly less than they currently do and some spend significantly more. If your brain hurts thinking about this, then just assume you will spend the same minus what you put into saving.

Our system at our firm Management assumes your expenses will grow at a given rate – some examples are 3 or 4 percent to account for inflation. Kiplinger (2) states that you need 78 percent of your income.

How long will I live?

Yep, this seems a bit morbid, but it’s necessary. If you want to pick a standard age, you can assume 90 to 95 to be conservative.

How many years will I spend in retirement?

This depends on when you want to retire, but it the average assumption is 30 years. Really, though, who knows? With medical advances, it may be longer.

Once you’ve answered these basic questions you will join the less than half of Americans who have calculated their figure. You’ll also be ready for the next step.

Step 2: Determine How Much to Save

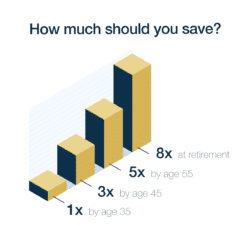

I love Fidelity’s very easy rule of thumb on how much of your income you should have saved by a certain age:

This is a great guideline, but it’s not tailored to your specific situation. That’s where finding a qualified financial advisor comes into play.

Your financial advisor or CERTIFIED FINANCIAL PLANNING™ professional will calculate the amount of money you should save and invest to achieve your goals.

Step 3: Determine Where that Money Comes From

You know how much you’ll need in your nest egg and how long that will need to last you, but how will you reach those goals? What vehicles should you use and why?

First, Social Security.

Yes, I know that no one believes it will available for us, but Social Security has funds to pay full benefits until 2033. It also has funds to pay 75 percent of benefits until 2086, according to the Social Security Administration. So for now, we will count Social Security income into our future nest egg.

I suggest you go to myssa.gov to create an account and find your estimated benefits. It will also provide your earnings record, which you can check for discrepancies or to show how far you’ve progressed in your career.

That brings us to our main vehicle for savings: retirement plans! Your advisor will help you determine the right amount to save and will also be able to explain the many benefits of these plans, but for starters:

- Traditional retirement accounts allow you to save more money by deferring tax payments until a later date, potentially allowing more money to grow for you.

- The growth accumulates tax deferred.

- Contributing to the plan lowers your taxable income.

- When you invest money, you have the benefit of compounding interest.

- Because the money is taken from your paycheck automatically, you are less likely to spend it.

- Many companies match your contribution. In fact, 86 percent of companies with retirement plans offer a matching program, and they match 4.5 percent on average. Yet, only one-third of employees take advantage of the full match, which is essentially free money once fully vested.

This topic hits home for me because I was surprised to find that my current savings schedule has me at financial independence at age 62.

My assumptions are conservative, and my lifestyle dreams will probably change by the time I reach my 60s. But the motivation I get from knowing that I may achieve one extra year of financial independence for every 2 percent I invest fuels me to continue on a disciplined path.

Whatever your dreams may be, make sure you are following a plan so that you can one day have the freedom to wake up and do what you’d like – whether it’s go on a hike, hit the snooze button or simply go to work because you want to.

Get started on your path to financial independence by talking with a our firm advisor today. Complete our online Retirement Readiness Quiz and we’ll reach out to you to set up a consultation.

References:

- Time.com, “Catch-Up Contributions Put Retirees Way Ahead,”https://time.com/4175048/401k-catch-up-contributions/?iid=sr-link6.

- Kiplinger.com,”Your Retirement Lifestyle,” https://www.kiplinger.com/article/retirement/T037-C000-S002-your-retirement-lifestyle.html